As one of the core pieces of the finance backbone of any company, the Order-to-Cash (O2C) process is crucial for maintaining healthy cash flow, improving customer satisfaction, and driving business growth. However, many companies don’t fully understand how their O2C operations are running today, or how to improve them.

The good news? Process intelligence can help you transform every part of the O2C process—from order management to fulfillment and delivery, all the way through to accounts receivable. By leveraging your existing data to power automated process discovery, you can uncover hidden inefficiencies like unnecessary order changes, lengthy processing times, and unmitigated risks.

In this blog we’ll give a closer look at practical strategies to streamline O2C and fuel business growth.

Understanding the Order to Cash Process

At its core, the Order to Cash (O2C) process is a critical business cycle that encompasses all steps involved in receiving and fulfilling customer orders, generating invoices, and collecting payments. It’s a comprehensive end-to-end workflow that begins with order management and extends through invoicing and payment collection. This sequence impacts not only your cash flow but also your reputation with customers. The operational efficiency and accuracy of the O2C process play a crucial role in a company’s financial health, as it directly affects revenue realization and the speed at which cash is generated.

The Order to Cash (O2C) process can be broken down into five key phases:

Order Entry: The O2C cycle begins with order entry, where customer orders are received, validated, and recorded in the system. Accuracy here prevents downstream delays that can delay fulfillment and impact the customer experience.

Order Fulfillment: Once the order is entered, it moves into the fulfillment phase. Here, the order is prepared, packed, and shipped to the customer. Efficient order fulfillment relies on seamless coordination between inventory management, warehouse operations, and logistics.

Invoicing: After the order is fulfilled, an invoice is generated and sent to the customer. The invoicing phase involves creating accurate invoices that reflect the agreed-upon pricing, taxes, discounts, and terms.

Payment Processing: The payment processing phase encompasses all activities related to receiving and recording payments from customers. This can include various payment methods, such as credit cards, bank transfers, or online payment systems.

Accounts Receivable Management: Finally, accounts receivable management involves tracking outstanding invoices and following up on overdue payments. This phase is crucial for maintaining healthy cash flow and reducing the days sales outstanding (DSO).

Each phase plays a vital role in business operations. Optimizing these steps reduces inefficiencies and sets the stage for sustained growth.

The Importance of O2C Process Improvement

A well-optimized O2C process offers tangible benefits, from faster lead times to better customer satisfaction. Here’s what you stand to gain:

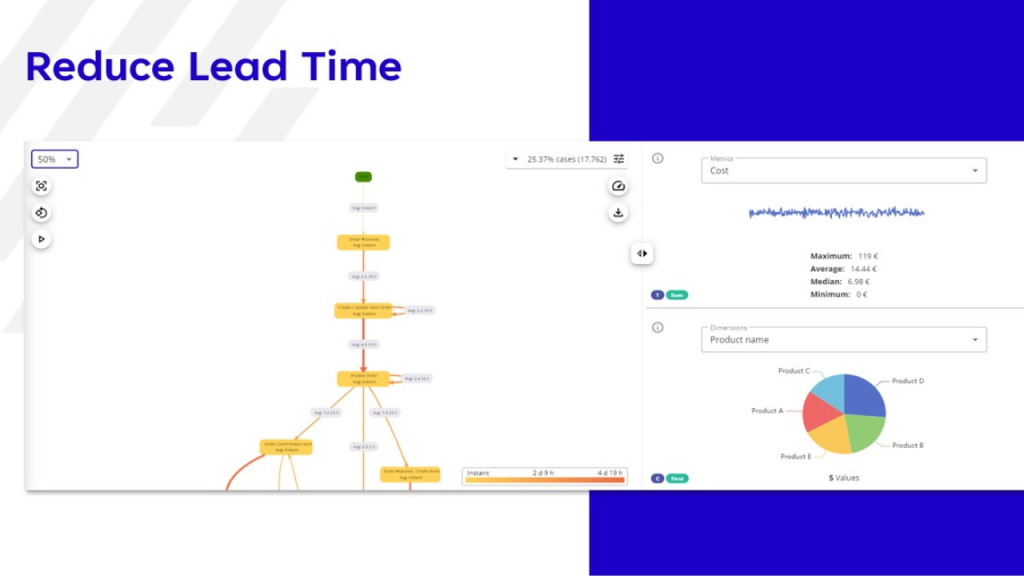

Reduce Lead Times

By optimizing the O2C process, companies can significantly shorten lead times, allowing orders to be processed, fulfilled, and invoiced faster. This not only improves cash flow but also strengthens customer relationships, as faster service meets the growing demand for quick turnarounds. Failing to reduce lead times can lead to bottlenecks, frustrating customers and potentially driving them to competitors.

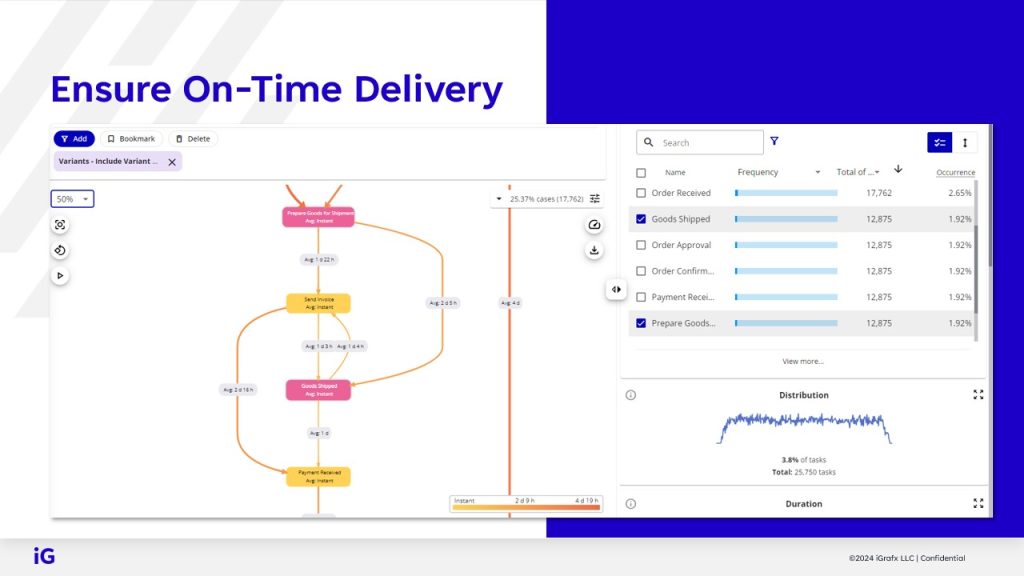

Ensure On-Time Delivery

A well-structured O2C process ensures that orders are delivered on time, meeting customer expectations and building loyalty. With improved visibility and communication across departments, companies can track orders accurately and proactively address potential delays. Without these improvements, late deliveries could damage customer trust and hurt long-term business growth.

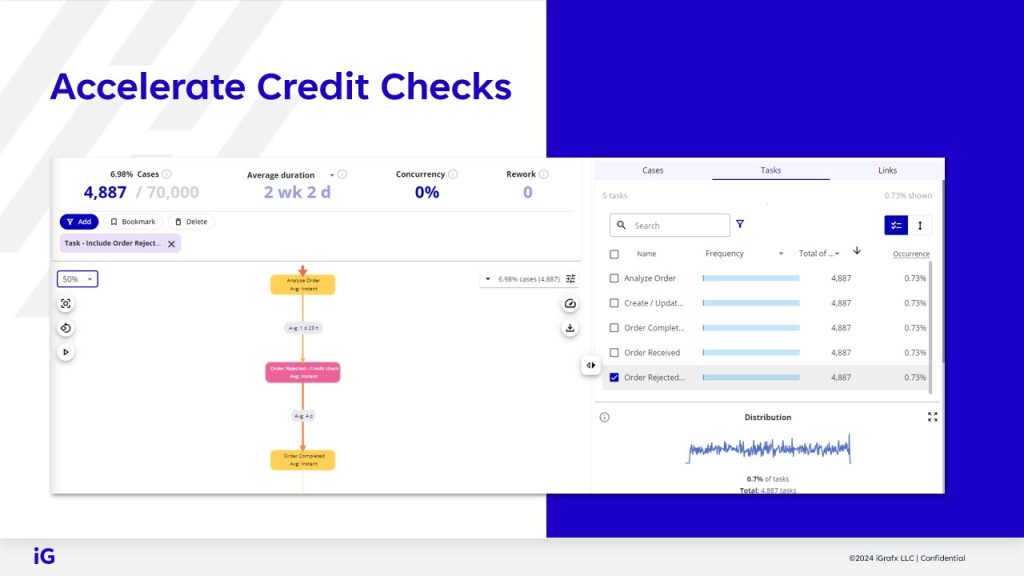

Accelerate Credit Checks

Enhancing the O2C process speeds up credit checks, allowing companies to approve orders and begin fulfilment quickly without risking cash flow. Streamlined credit approvals mean fewer delays at the front end of the process, helping to maintain consistent revenue streams. Neglecting to accelerate credit checks can result in prolonged order cycles, increasing the risk of revenue loss and customer dissatisfaction.

Improve Automation Maturity

Enhancing automation within the O2C process reduces manual tasks, minimizes errors, and enables faster, more consistent processing. By increasing automation maturity, companies can streamline workflows and free up team members for higher-value activities, ultimately accelerating the cash flow cycle. Failing to improve automation can lead to inefficiencies, increased operational costs, and higher error rates.

Increase Customer Satisfaction

An optimized O2C process improves order accuracy, speeds up delivery times, and ensures seamless interactions with customers. When customers experience reliable and timely service, their satisfaction and loyalty grow, strengthening the company’s reputation and fostering repeat business. Without improvements, delays and errors can erode customer trust and push them toward competitors.

Reduce Change Requests and Rework

By enhancing transparency and consistency in the O2C process, companies can lower the frequency of order change requests and rework, which are often costly and time-consuming. Reducing these disruptions enables teams to work more efficiently and maintain a higher level of quality. Ignoring the need for improvements in this area can lead to increased cycle times, frustrated employees, and missed revenue opportunities.

Failing to address inefficiencies risks losing customers to competitors, delayed payments, and rising operational costs.

Identifying Areas for Improvement

The first step in transforming O2C is gaining transparency into current processes. Without clear visibility, organizations struggle to see where bottlenecks, delays, or inefficiencies are impacting performance. This transparency allows companies to understand how each step in the O2C process is actually executed, rather than relying on assumptions or outdated process maps.

Establishing transparency also enables organizations to create key performance indicators (KPIs) that set measurable benchmarks for success. These KPIs are essential for establishing a baseline that can guide targeted improvements. With a data-driven understanding of lead times, on-time delivery rates, and credit check efficiencies, companies can focus on areas that will deliver the highest impact, ensuring that changes are both meaningful and sustainable.

Process mining technology can play a critical role in achieving this level of transparency and insight. By capturing real-time data from existing systems, process mining reveals exactly how processes are performed, where deviations occur, and where there may be gaps between planned processes and actual execution. This enables a comprehensive view of the O2C process, highlighting inefficiencies that manual observation might miss.

Best Practices for O2C Process Improvement

There are a number of best practice approaches companies should consider when looking to drive efficiency, improve customer satisfaction, and support long-term growth.

- Leverage Process Mining to Uncover Bottlenecks and Inefficiencies

Start by using process mining tools to analyze the actual performance of your O2C process. Process mining provides a data-backed view of each step, from order placement to invoicing and payment. This transparency enables you to spot bottlenecks, such as delays in credit checks or order fulfilment, that may be slowing down the overall cycle. - Design for Cross-Functional Collaboration and Workflow Automation

An optimized O2C process involves smooth coordination between multiple departments, including sales, finance, and supply chain. Use process design tools to create standardized workflows that encourage seamless communication and reduce manual handoffs. Consider automating repetitive tasks, such as invoicing and payment reminders, to increase efficiency and minimize errors. - Use Process Simulation to Test and Validate Improvements

Before implementing major changes, use process simulation to test potential modifications within your O2C workflow. Simulation allows you to model the impact of changes—such as adjustments to lead times, credit policies, or inventory management strategies—on the overall process. This testing helps ensure that improvements deliver real benefits without unintended side effects, such as increased costs or operational strain. - Identify Patterns & Take Proactive Actions with Predictive Analytics Predictive analytics analyzes historical data, customer behavior patterns, and market trends to provide insights into future order volumes, payment cycles, and potential bottlenecks. With this, companies can anticipate demand fluctuations, adjust inventory levels, and proactively allocate resources, ensuring smoother order fulfillment and reducing lead times. It can also help identify patterns in customer payment behaviors, allowing businesses to assess the likelihood of delayed payments and take preventive actions, such as proactive credit checks or payment reminders.

Optimizing the O2C Process for Compliance

Examining and optimizing the Order to Cash (O2C) process plays a vital role in helping companies meet various regulatory requirements, including financial reporting, data protection, consumer protection, and Environmental, Social, and Governance (ESG) standards. By streamlining and closely monitoring each stage of the O2C process, companies can ensure that all transactions are accurately documented, reducing the likelihood of errors in financial reporting. This accuracy is essential for regulatory compliance, as well as for maintaining transparency and trust with stakeholders. Enhanced visibility into financial transactions allows organizations to respond quickly to audit requests and maintain clear, compliant records, minimizing the risk of costly non-compliance penalties.

ESG compliance is increasingly important for companies looking to demonstrate their commitment to sustainability and responsible business practices. By improving the efficiency of the O2C process, companies can better track and report on environmental metrics, such as paperless transactions or supply chain emissions, to meet ESG goals.

Building a Digital Twin of Your O2C Process

Creating a digital twin of a company’s Order to Cash (O2C) process can be a powerful driver for improvement efforts. A digital twin is essentially a virtual replica of physical operations—in this case, the O2C process—that allows organizations to model, monitor, and optimize their workflows in a risk-free, simulated environment. By building this virtual model, businesses gain a real-time understanding of how their processes are truly performing, identifying inefficiencies and bottlenecks that may not be immediately visible otherwise.

Process mining plays a critical role in constructing the digital twin by providing accurate, data-driven insights into the reality of operations. With live data connections, companies can continuously monitor the O2C process, receiving real-time updates on its performance. This monitoring enables teams to detect and address issues proactively. Additionally, simulation capabilities allow organizations to test process changes within the digital twin before implementing them in real life, minimizing the risk of unintended consequences, such as new bottlenecks or missed ROI targets.

Digital twins make it possible to:

- Proactively address emerging issues.

- Measure the impact of process changes without risk.

- Ensure compliance with financial reporting and ESG standards.

Conclusion

Transforming the Order to Cash (O2C) process is a strategic move that can yield significant improvements in efficiency, compliance, and customer satisfaction. By leveraging tools like process intelligence, process mining, and predictive analytics, companies gain crucial insights into their operations, enabling data-driven decisions and proactive optimization. Building a digital twin of the O2C process adds another layer of value, allowing organizations to model and test improvements in a risk-free environment, ensuring changes lead to positive outcomes. Embracing these strategies equips businesses to streamline their cash flow, enhance service delivery, and build a resilient, adaptable O2C process that drives sustained growth.

To learn more about the iGrafx Process360 Live platform and to get started today, contact us.

Frequently Asked Questions

What is the O2C cycle, and why is it important for operational efficiency?

The O2C (Order to Cash) cycle encompasses all steps from receiving a customer order to collecting the payment. Optimizing this cycle is crucial for operational efficiency as it accelerates cash flow, reduces bottlenecks, and enhances the customer experience by ensuring timely and accurate order fulfilment.

How can transforming the O2C cash process help reduce human error?

Streamlining the O2C cash process with automation tools minimizes reliance on manual processes, which are often prone to human error. By reducing manual data entry and automating repetitive tasks, companies can achieve greater accuracy, reduce errors in order processing and invoicing, and improve overall process quality.

How can improving the O2C cycle address issues with late payments?

By optimizing the O2C process, companies can establish a more efficient invoicing and payment collection system, reducing the likelihood of late payments. Streamlined credit checks and automated payment reminders help ensure that invoices are paid on time, enhancing cash flow and financial stability.

What are the benefits of automating manual processes in the O2C cycle?

Automating manual processes within the O2C cycle reduces the time and effort needed for tasks like order entry, invoicing, and payment processing. This shift enhances operational efficiency, frees up staff for higher-value work, and ensures faster, more consistent handling of customer orders, ultimately improving business processes.

How can process intelligence tools improve business processes within the O2C cycle?

Process intelligence tools provide visibility into the O2C cycle, identifying inefficiencies and areas for improvement. By using data-driven insights, businesses can optimize each phase of the cycle—from order management to payment collection—driving efficiency, reducing errors, and ultimately enhancing the entire cash process.