Process mining is a powerful technique that involves analyzing and visualizing business processes based on event data from IT systems. It helps organizations uncover inefficiencies, bottlenecks, and areas for improvement by providing a clear, data-driven picture of how processes are actually performed.

Process mining in insurance has the potential to drive significant transformation. With its ability to uncover hidden inefficiencies and provide insights into claims processing, compliance workflows, and customer interactions, process mining in insurance is poised to help companies improve operational efficiency and deliver superior customer service.

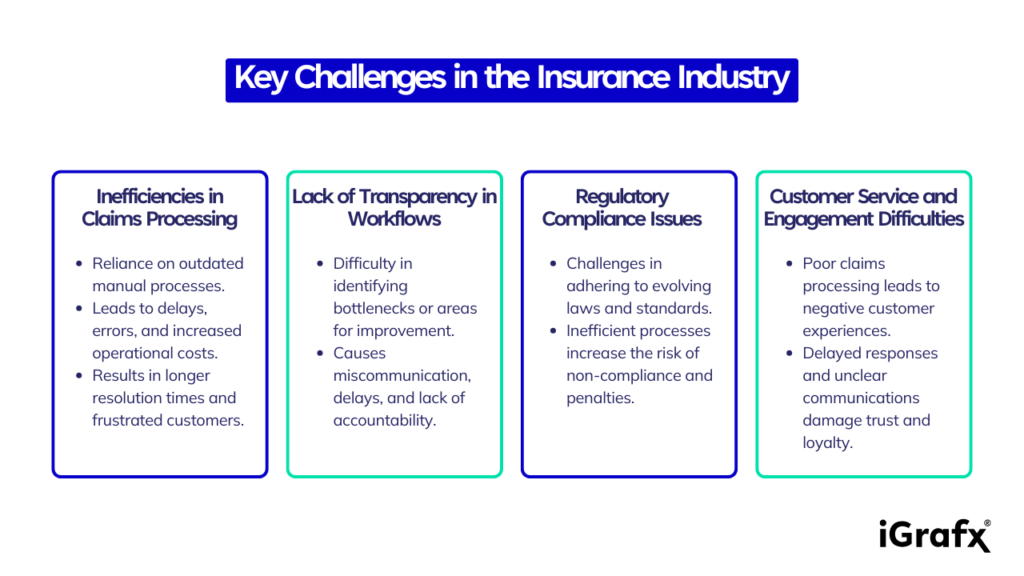

Key Challenges in the Insurance Industry

The insurance industry continues to face numerous challenges that hinder efficiency, customer satisfaction, and compliance. Here are some of the most pressing issues:

- Inefficiencies in Claims Processing: Many insurance companies still rely on outdated manual processes, leading to delays and errors in claims handling. These inefficiencies result in increased operational costs, longer resolution times, and frustrated customers.

- Lack of Transparency in Workflows: Without clear visibility into the various stages of claims processing, it becomes difficult to identify bottlenecks or areas for improvement. This lack of transparency often results in miscommunication, delays, and a lack of accountability within the organization.

- Regulatory Compliance Issues: The insurance industry operates within a complex regulatory environment. Companies are tasked with adhering to constantly evolving laws and standards across regions, making it challenging to ensure consistent compliance. Inefficient processes increase the risk of non-compliance, potentially resulting in costly penalties.

- Customer Service and Engagement Difficulties: With increasingly demanding customers, poor claims processing and lack of transparency in workflows lead to negative experiences. Delayed responses, unclear communications, and lengthy claims resolutions can damage customer trust and loyalty, making it difficult to maintain long-term relationships.

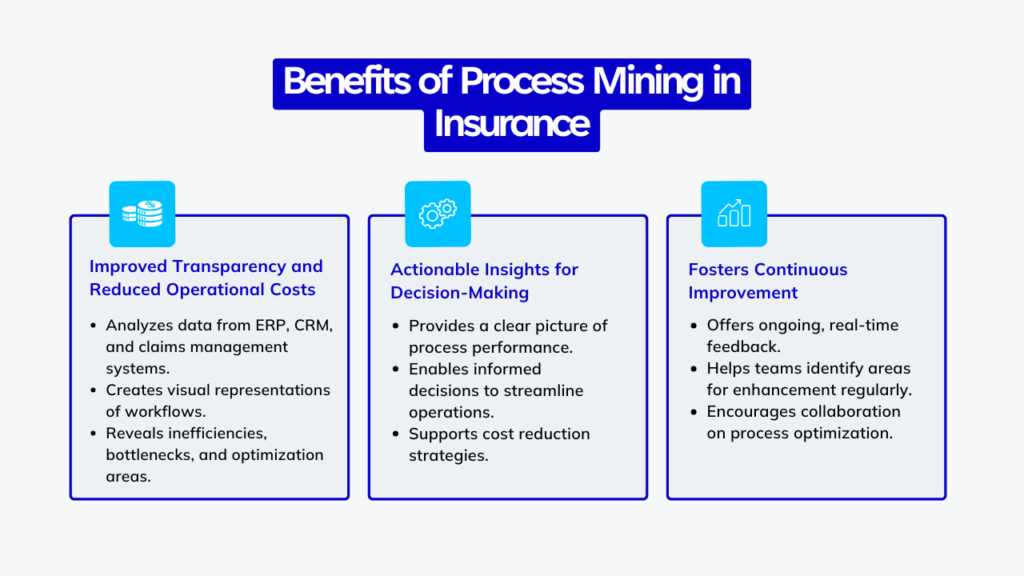

Understanding the Benefits of Process Mining in Insurance

Process mining in insurance helps companies achieve improved transparency and reduced operational costs by analyzing data from various sources, such as enterprise resource planning (ERP) systems, customer relationship management (CRM) platforms, and claims management software. By consolidating this data, process mining in insurance creates a clear, visual representation of workflows, revealing inefficiencies, bottlenecks, and areas for optimization.

The benefits of improved data visibility are significant: organizations gain actionable insights into how processes are performing, enabling them to make informed decisions that streamline operations and reduce costs.

Moreover, process mining in insurance fosters a culture of continuous improvement by providing ongoing, real-time feedback, helping teams identify areas for enhancement on a regular basis. This data-driven approach empowers employees to collaborate on process optimization, ultimately driving sustained operational efficiency and cost savings.

Implementation of Process Mining in Insurance

Implementing process mining solutions requires a strategic approach to ensure successful integration and maximum impact. Here are the key steps to guide the implementation process:

Assessing Current Processes

Before implementing process mining, insurance companies must first understand their existing workflows. This involves mapping out the current state of processes such as claims management, underwriting, and policy renewals. By collecting data from various systems and identifying pain points, companies can pinpoint areas that need optimization. This assessment helps define clear goals and ensures that process mining is aligned with business objectives.

Selecting the Right Tools and Technologies

Choosing the right process mining tools and technologies is critical to success. Insurance companies should evaluate solutions that integrate seamlessly with their existing IT infrastructure and offer scalability for future growth. Solutions like iGrafx provide advanced process mining capabilities that enable real-time analysis and actionable insights, empowering teams to make data-driven decisions and optimize key workflows efficiently. The right tools will also ensure easy data integration from various sources, including claims management systems, CRM platforms, and ERP solutions.

Training Employees and Stakeholders

To fully capitalize on process mining, it’s essential to train employees and key stakeholders on how to use the new tools and interpret the data. Insurance professionals—from claims adjusters to compliance officers—should understand how process mining insights can be applied to improve their daily tasks and workflows. Providing training sessions, workshops, and ongoing support will ensure that the team is equipped to leverage process mining for continuous process improvement and innovation.

Specific Areas Where Process Mining Can Help

Streamlining Claims Processing

Process mining streamlines claims handling by providing insurers with detailed insights into actual workflows and operations. By analyzing data from systems like claims management and customer interactions, process mining uncovers inefficiencies and delays. This enables insurers to identify bottlenecks and unnecessary steps, optimizing and automating the process. With a clearer understanding of each claims step, insurers can reduce manual work, improve resource allocation, and ensure faster claims processing.

Reducing turnaround times is a key benefit of process mining in claims management, directly boosting customer satisfaction. Efficient processing leads to quicker resolutions, fewer errors, and greater transparency. For example, before process mining, delays in claims approval often resulted in customer frustration. After implementation, the insurer can address bottlenecks, speeding up approvals and improving communication. This enhances customer trust and loyalty by offering a more responsive and streamlined experience.

Enhancing Customer Experience

Understanding customer journeys is crucial for insurance companies looking to stay competitive in today’s customer-centric marketplace. By mapping the entire experience—from initial contact to policy renewal — insurers gain valuable insights into customer needs, preferences, and pain points. This understanding enables insurance providers to tailor their offerings at each stage, delivering the right products, services, and support. Using process mining and data analytics, insurers can identify areas where customers drop off or face delays, allowing them to optimize processes and improve satisfaction.

Aligning services with customer expectations is key to fostering loyalty and trust. Today’s consumers expect seamless, personalized experiences, whether buying a policy, filing a claim, or seeking support. By leveraging data insights, insurers can create highly relevant offerings tailored to individual customers. These insights help customize products and services based on demographics, past interactions, and behavior patterns. Personalization at scale enhances satisfaction, increases engagement, and drives retention, ultimately boosting revenue.

Regulatory Compliance and Risk Management

Process mining plays a critical role in ensuring compliance within the insurance industry by providing deep visibility into business workflows. By analyzing data from various systems, process mining helps organizations identify inefficiencies, bottlenecks, and deviations from established procedures that could lead to non-compliance. This data-driven approach enables insurers to proactively address compliance gaps and align processes with regulatory requirements, minimizing the risk of fines or penalties.

Moreover, process mining streamlines reporting and documentation, making it easier to generate accurate and timely reports required for regulatory audits. The ability to track and document each step in a process ensures that insurers have a clear and comprehensive record of their operations. Through continuous data analysis, process mining also helps identify potential risks and anomalies, allowing businesses to mitigate issues before they escalate. By uncovering these hidden threats, insurers can reduce operational risks and maintain a compliant, efficient workflow.

Conclusion

To learn more about iGrafx’s process mining solutions, contact us for a consultation on how to get started.