In the competitive world of financial services, operational excellence isn’t just a nice-to-have, it is what sets industry leaders apart. Whether it’s speeding up loan approvals, improving KYC (Know Your Customer) processes, or enhancing the customer onboarding experience, finding smarter, more efficient ways to work is crucial. That’s where digital twins come in. Think of them as virtual replicas of your organization’s real-world operations, providing a clear, data-driven view of how things actually run.

Imagine a bank struggling with delays in loan processing. By using a digital twin, they can pinpoint exactly where bottlenecks occur—whether it’s during document verification or credit checks—and simulate solutions to fix them before implementing changes. It’s this blend of visibility and actionable insights that makes digital twins a game-changer.

In this blog, we’ll explore how financial institutions can pair digital twins with process intelligence, process simulation, and predictive analytics to tackle inefficiencies, boost compliance, and create experiences that truly impress customers. If you’re looking for practical ways to stay ahead, this is for you.

Market Factors Impacting Digital Transformation

Digital transformation has become a critical driver for business survival and growth as companies face unprecedented levels of competition, disruption, and change. However, digital transformation isn’t without its hurdles. From dealing with outdated legacy systems to juggling regulatory demands and the increasing complexity of operations, the road can get bumpy. Companies also need to strike the right balance—innovating boldly while staying aligned with their goals and customer expectations. Tackling these challenges takes more than just the right tools; it calls for a thoughtful, collaborative approach that keeps resilience and efficiency at the forefront.

Customer Experience

Customers today expect instant, personalized interactions—whether they’re booking a service, resolving an issue, or making a purchase. To keep up, businesses must constantly refine their digital channels, ensuring they remain relevant, engaging, and frustration-free. It’s no longer just about keeping up with competitors; it’s about meeting the high bar customers set every day.

War for Talent

As the demand for digital skills soars, companies are struggling to attract and retain talent skilled in cutting-edge technologies. The talent gap creates bottlenecks in executing digital transformation initiatives effectively, hampering progress and slowing innovation.

The Rise of AI

AI brings endless possibilities but integrating it into existing operations isn’t as simple as flipping a switch. From deciding where AI can add the most value to ensuring the right data is in place, many organizations are navigating uncharted territory. The potential is enormous—but so is the learning curve.

Shifting Regulatory Landscape

Navigating ever-changing regulations around data privacy, cybersecurity, and compliance can feel like running a marathon on shifting sand. Organizations must constantly tweak their digital strategies to meet new requirements while staying focused on innovation and growth. It’s a delicate balance, but one that’s impossible to ignore.

Sustainability Goals

Sustainability is now expected in today’s world. Integrating green practices into digital strategies is vital, but it often comes with steep costs and complexities. From reducing energy consumption in data centers to aligning with eco-conscious consumer demands, sustainability is a challenge that can’t be sidelined.

Achieving Strategic Outcomes in Financial Services

Financial services firms are striving to meet ambitious goals that keep them competitive while meeting the rising expectations of customers, employees, and regulators.

Higher Return on Investments

Maximizing profitability is always a priority, and companies are honing their investment strategies and resource management to achieve it. By reducing time spent resolving issues and tapping into process automation, firms can cut costs and drive better returns—a win-win for stakeholders and the bottom line.

Employee Experience & Operational Excellence

A happier, more productive workforce translates into better business outcomes. By using process analytics to identify inefficiencies and reduce time on tasks, companies can create a smoother workflow. The result? Employees who feel valued and empowered to focus on higher-impact work, fostering a culture of operational excellence.

Regulatory Compliance

Regulations in the financial world never stand still. To keep up, firms are turning to process monitoring tools that provide real-time alerts and insights. These tools help businesses stay ahead of shifting requirements, reducing compliance risks and safeguarding against fines—all without breaking stride in their operations.

Customer Satisfaction

Customer loyalty hinges on delivering seamless, tailored experiences that show clients they’re more than just a number. By standardizing key processes and personalizing interactions, financial services can build the trust and confidence that keeps customers coming back. It’s not just about meeting expectations—it’s about consistently exceeding them.

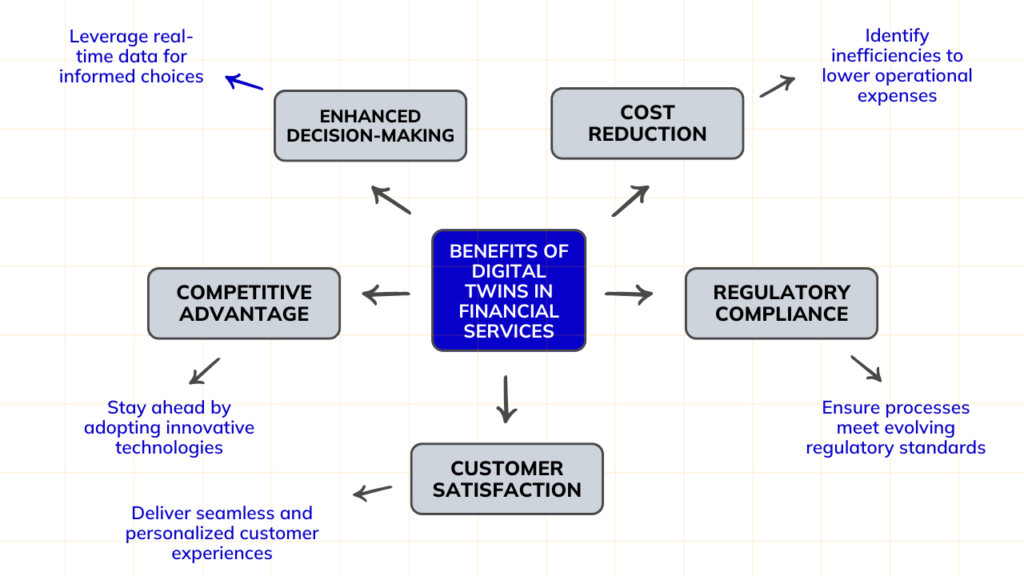

Understanding Digital Twins in Financial Services

Digital twins are virtual replicas of real-world processes, assets, or systems, designed to simulate and optimize operations. In financial services, they provide a powerful way to model workflows, capture real-time data, and deliver actionable insights that drive smarter decision-making. From customer journeys to internal operations, digital twins enable financial institutions to visualize and refine every step with unparalleled clarity.

Take customer onboarding, for instance. A bank can use a digital twin to create a dynamic model of the entire process, revealing inefficiencies, bottlenecks, or compliance gaps. With tools like process mining and process intelligence, the digital twin offers insights that reduce onboarding times, improve adherence to regulations, and enhance the customer experience. And because the model operates virtually, institutions can experiment with changes, validate improvements, and optimize workflows without disrupting day-to-day operations.

By leveraging digital twins, financial organizations can stay agile and resilient, continually refining processes to deliver better outcomes for customers and employees alike.

Enhancing Customer Experience through Hyper-Personalization

Digital twins are a great fit for creating hyper-personalized experiences in financial services. With process intelligence, institutions gain a detailed view of customer behaviors and preferences. Predictive analytics then helps anticipate needs—whether it’s recommending a tailored investment plan or providing proactive support.

Imagine a customer opening a bank account. Using a digital twin, the institution can simulate every touchpoint to understand how each interaction impacts satisfaction. By fine-tuning processes, they can make onboarding faster and smoother, leaving a lasting positive impression. This kind of personalization not only delights customers but also fosters long-term loyalty in an increasingly competitive industry.

Continuous Process Improvement and Operational Efficiency

Digital twins also shine when it comes to operational excellence. With real-time insights, financial institutions can dig into processes like loan approvals or account management to uncover inefficiencies and streamline operations. For instance, process mining can reveal where delays occur, enabling teams to make adjustments that keep workflows on track.

Picture a team automating a repetitive reconciliation task. By testing this change within the digital twin, they can validate its impact without risking real-world disruptions. The result? Optimized resources, increased productivity, and significant cost savings—all while employees are freed to focus on more strategic activities.

Preparing for Generative AI Integration

Generative AI is poised to transform financial services, but its success depends on a solid foundation of data and insights—something digital twins excel at providing. By modeling AI-driven processes within a digital twin, banks can safely explore how new AI tools affect customer interactions or compliance efforts before rolling them out.

For example, a bank could simulate an AI chatbot handling customer queries. The digital twin can predict its efficiency and potential pitfalls, ensuring seamless implementation. With this approach, institutions can integrate AI as a meaningful advantage without unnecessary risks, staying ahead of the curve in innovation.

Cost Reduction through Improved Operational Efficiency

Digital twins are a powerful ally in cost reduction. By revealing inefficiencies in processes like cash handling or credit management, they help financial institutions eliminate redundancies and improve resource allocation.

Take late payment forecasting. Using predictive analytics within a digital twin, a bank can identify patterns that flag potential issues early, allowing them to intervene before problems escalate. This proactive approach saves time, reduces manual efforts, and minimizes costs related to compliance violations or customer dissatisfaction.

Strengthening Compliance and Operational Resilience

In a heavily regulated industry, compliance is non-negotiable. Digital twins provide a transparent, real-time view of processes like KYC or Order-to-Cash, enabling institutions to monitor adherence to standards and quickly correct deviations.

When audit season rolls around, having a virtual replica of operations simplifies the process. Financial institutions can simulate compliance scenarios, ensuring their procedures align with regulations. This proactive stance not only makes audits easier but also embeds resilience into day-to-day operations, reducing the risk of penalties and bolstering trust.

Competitive Edge Through Actionable Insights and Advanced Analytics

The ability to adapt quickly is a hallmark of successful financial institutions, and digital twins provide the actionable insights needed to do just that. By analyzing customer trends and process performance, organizations can stay ahead of shifting market demands.

For instance, tracking customer preferences through a digital twin might reveal a growing interest in eco-friendly investment options. Acting on this data, a bank could develop new offerings, meeting demand before competitors catch on. With real-time adjustments and forward-looking analytics, financial institutions can remain agile and responsive, carving out a strong competitive edge.

The Future of Financial Services: Digital Twins as a Strategic Asset in Operational Excellence

Digital twins represent a strategic asset for financial institutions, enabling them to transition from reactive to proactive management of their business processes. With a digital replica of their operations, banks and financial services organizations can continuously monitor, analyze, and improve their workflows, fostering a culture of data-driven decision-making.

The potential business outcomes are significant:

- Improve productivity by decreasing resolution times for onboarding, customer service and claims handling.

- Reduce the cost of customer acquisition, service tickets and claims.

- Ensure compliance by enhancing AML process oversight, achieving faster identification of non-compliant activities, and decreasing audit time and cost.

- Increase CSAT by improving first-call resolution rates and acquiring multi-product customers.

Conclusion

Embracing digital twins in financial services offers a clear path to operational excellence. By combining process intelligence, predictive analytics, and real-time monitoring, digital twins allow financial institutions to streamline their processes, enhance compliance, and deliver superior customer experiences. The future of financial services lies in the intelligent use of digital twins to transform business processes, drive continuous improvement, and achieve new levels of efficiency and customer satisfaction.

Curious how to get started with building a digital twin in your organization? Contact us today to learn more and see Process360 Live in action.